Apply for Import Export Code (IEC) Online | Same Day Processing | Anywhere from India

Register your import export business under Directorate General of Foreign Trade, Ministry of Commerce and Industry, Govt. of India. IEC expert of Online Legal India™ will file with the DGFT office on your behalf.

Import Export License (IEC) Registration Form

Get FREE advice from IEC Experts – Get Started

• The bank needs it to transfer the money when imports are made.

• Similarly during export the shipments the IEC is required.

• When exporter is supposed to receive money in foreign currency, IEC code is required to transfer the money to his account directly.

| IEC Registration Fees | |

| Aayaat Niryaat Form Submit | Zero |

| Filing at DGFT | Zero |

| Professional Fees | Rs. 1999 |

| Govt. Fees (Exclude) | Rs. 500 |

| Rs. 1999 Only | |

The IEC code registration is applicable for all business registrations:

- Proprietorship

- Partnership

- LLP

- Limited Company

- Trust

- HUF

- Society

How we work?

Fill-up the Form & make the Payment

⟶

Get a call from IEC expert

⟶

Upload the Documents and Declaration as requested

⟶

Dedicated IEC Expert will Apply for IEC License

⟶

Congratulations! Your Import Export Code will be Sent to You

👍

Document Required

- Two Colour Photographs of Promoters/Individuals/ Company/ Director

- PAN Card of each Shareholders and directors

- Identity Proof (Voter ID / Driving License/ Passport)

- Address Proof (Bank Statement / Electricity, Mobile, Telephone Bill)

- Proof of Registered Office

- Utility Bill as proof must be Latest

Advantages of IEC for Import Export Businesses

International Market Reach

Import Export Code helps you in order to take your business to the international market. Not only that, it will increase your revenue as well as growth.

Niryat Bandhu Scheme

The Niryat Bandhu scheme of DGFT Main Objective is to Help Entrepreneurs, Exporters, Importers, and students of this Subject to help learn and provide certification in Export & Import Management.

Reduces the Risk of Illegal Transportation

IEC helps you to get rid of any illegal transportation or fraudulent imports and exports. IEC registration is a centralized registration which helps the officials to supervise and manage the transaction in a better manner which is undertaken as a part of cross border business.

Easy Avail Benefit of Govt. Schemes

IEC Code offers great benefit for Import Export business. An IEC registered business entity would be qualified to avail benefits or subsidies declared by the Customs, Export Promotion Council and other several authorities. After filing Letter of Undertaking under GST, the exporters are not required to pay taxes to make exports. If the exports are made by payment of taxes, the exporter can claim refunds of the paid tax amount.

Other Benefits

Companies that register for the Import Export Code could make the most of several other benefits offered by customs, the Export Promotion Council, and the Director General of Foreign Trade.

Popular Services

Legal Service Online

Trade Mark Registration

Import & Export Code

Tax Service

Consumer Complaint

Company Registration

INDIA’S LEADING LEGAL SERVICE PROVIDER

![]()

Why Us ?

Recognized by Govt. of India

1 Lakh+ Happy Customers Across India

ISO Certified

Data Security & Trust

Trained & Professional Experts

On Time Service

Super Fast Service

24x7 Platform

Affordable Than Other Professionals

FAQ

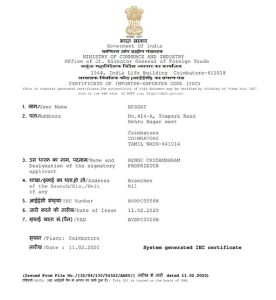

IEC (Import Export Code) is mandatory for anyone who is looking to start his/her import/export business in India. It is issued by the DGFT (Director General of Foreign Trade). IEC is a 10-digit code which has lifetime validity.

All IEC holders are now legally required to update and validate their IEC Details, even if there are no changes, from April to June once every year through Online system, failing which their IEC shall be de-activated and no import or export activity will be possible.

- Rs. 1999 (If your aadhaar is linked with your mobile or if you have DSC)

- If your mobile number is not linked with aadhaar then you must have DSC (Digital Signature Certificate)

- A nominal fee of Rs. 500 is paid to the government.

It generally takes only 1 day to get your Import Export Code/IEC License. But in certain cases, it may take another day since it is based on final approval from DGFT. So it takes 1-5 working days to get your Import Export License registration certificate.

No, you cannot import legally if you do not possess a valid Import Export Code Registration Certificate. As per current notification by DGFT (Directorate General of Foreign Trade), No export or import shall be made by any person without obtaining an IEC unless specifically exempted.

Yes, IEC number is reflected in all customs documents related to exports and imports.

As trade is not possible without a valid IEC, the penalty levied may be the pay duty depending upon the quantum of the goods.

Anyone who is acting as sole proprietor of a business can obtain IE code Registration.

IE Code is not a tax registration. However, certain customs duty may be levied depending on the product.

No. Only 1 IEC is issued to a person/entity. So if more than 1 IEC code is issued, then the same should be surrendered to the Regional Office for cancellation.

Incorporation

Incorporation

Trademark

Trademark